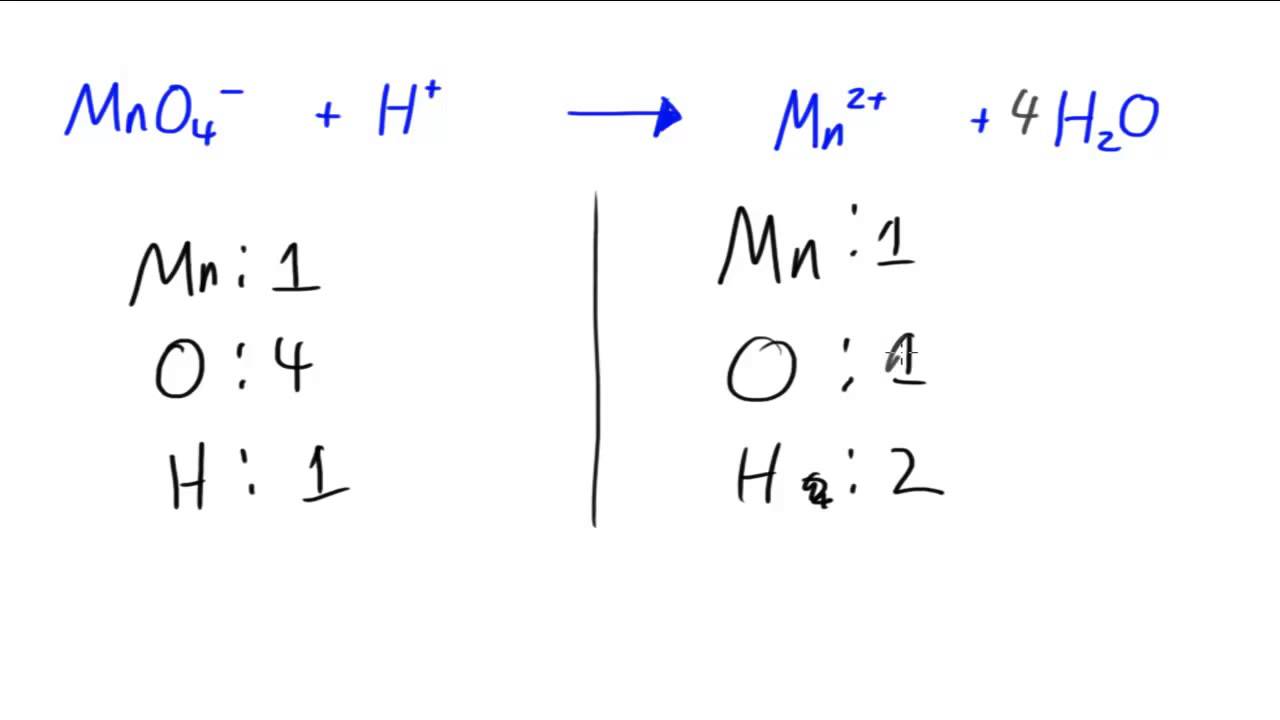

Since this is a addition benefit it would be taxable referred as Balancing Charge. The total positive and total negative charge will always be equal and will be the least common multiple LCM of the charges of the positive and negative ions.

She has claimed 5000 worth of capital allowances on.

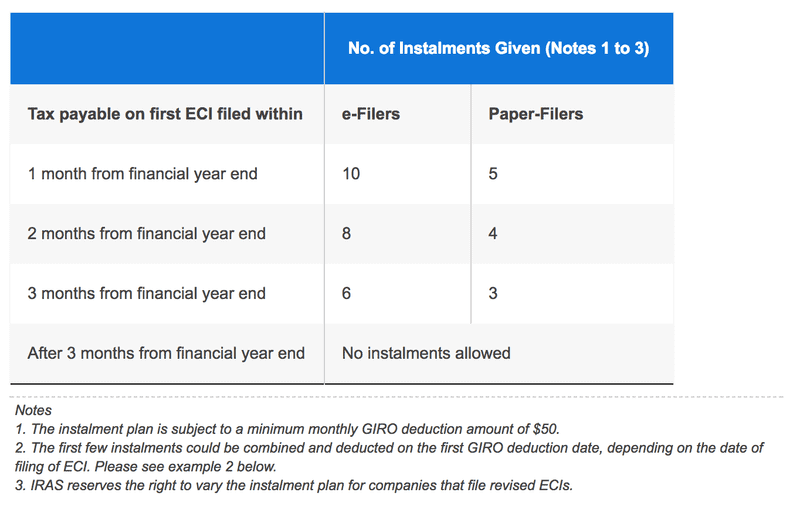

. The number printed on page TR 1 of your tax return the SA Helpline on 0300 200. New balance you owe B CBO A Where. A balancing charge is calculated by adding the value of the sale price to the claimed capital allowances then subtracting the price of your original purchase.

Finance charge A CBO APR 001 VBCBCL. The algorithm of this finance charge calculator uses the standard equations explained. - If Days then BCL 365.

- If Weeks then BCL 52. For example if the APR is 18 with 12 billing cycles the monthly rate would be 15. You calculate the balancing adjustment amount by comparing the assets termination value for example the sale proceeds with its adjustable value the cost of the asset less depreciation deductions.

Example of a balancing charge. In this case you would have made a loss of 6000 ie. BCL Billing cycle length corresponding index.

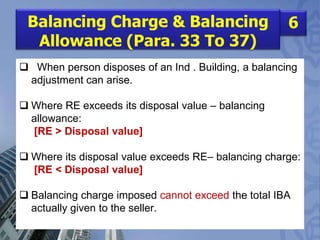

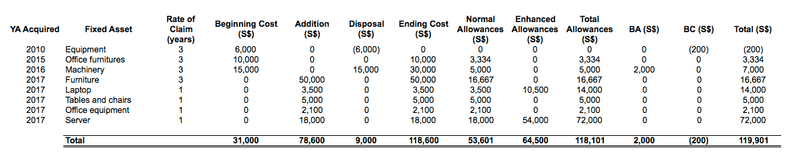

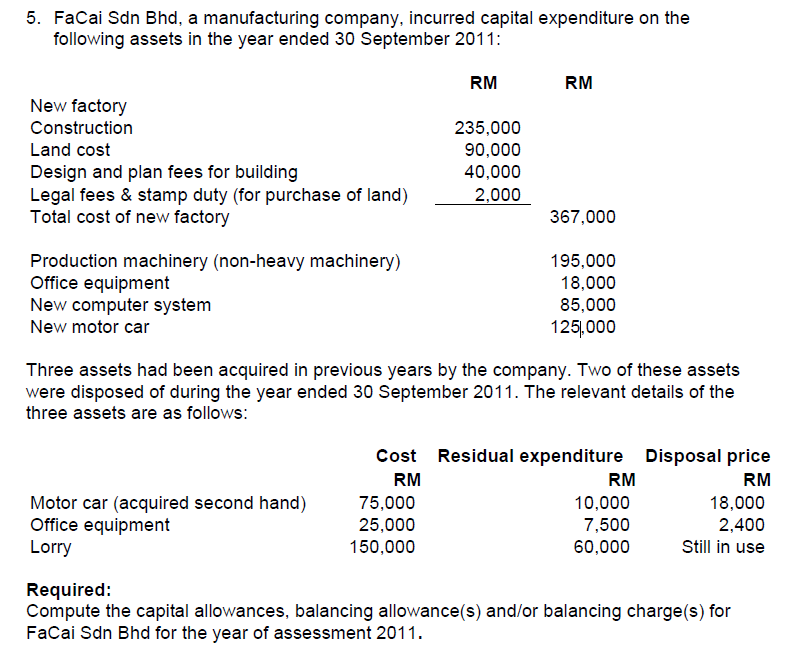

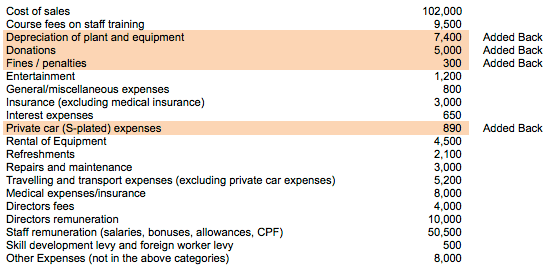

Balancing charge and Balancing allowance. When a fixed asset is sold or written off you need to calculate balancing allowance or balancing charge if capital allowance has been claimed for the asset previously. Balancing allowance is tax deductible whereas Balancing charge is taxable income.

Battery Cell Balancing - Texas Instruments. The tax written down value of the laptop which is the original price minus the AIA is 0. This neutrality equation is designed in a way where the molarity concentrations of cations along with their charge coefficients equal the molarity concentrations of anions and their charge coefficients.

Charge Balance-The sum of positive charges equals the sum of negative charges in solution Electroneutrality. No initial allowance IA is given to the buyer. The right-hand side of the equation should be roughly equal to the left-hand side.

This is a balancing charge. Credit card issuers use one of several methods to calculate your finance chargesthe fee you pay whenever you carry a balance on your credit card. The finance charge is the APR Annual Percentage Rate adjusted for the number of billing cycles in a year times the average daily balance.

Demonstration of Balancing charge in binary ionic compounds. If the assets termination value is more than its adjustable value include the difference in your assessable income. As this is more than the tax written down value you must add a balancing charge to your annual profit when you do your tax return.

The equation is. 10000 Sales price-20000 purchase price-4000 capital allowance Since this a loss. CBO Current Balance owed.

All finance charges at a stated interest rate are added to your balance on a regular basisDepending on the card issuer the finance charges may be added daily monthly or at some other rate. 73 Restriction of balancing charge The amount of balancing charge to be added back to the adjusted income of a business source is restricted to the amount of capital allowances that have been allowed in respect of the asset. While computing a companys Wear and Tear Allowance.

It would be allowed as deduction from your taxable profit as. To calculate the balancing charge add the amount you sold the item for to the capital allowances you claimed then subtract the amount you originally bought the item for. Mary a driving instructor bought a car for her business six years ago for 11500.

Protons and hydroxide ions are always present due to the dissociation of water. The charge balance equation is used to solve for a missing concentration of an ion. If you sell an item you claimed capital allowances for and the sale or value of the item is more than the balance in the pool you add the difference between the 2 amounts to.

The buyer will claim annual allowance AA based on the TWDV of the asset over the remaining working life If the buyer subsequently sells the asset the buyer will be subject to the BC BA rules. Or in summation form. It is not necessary to calculate balancing allowance BA or balancing charge BC for the seller.

APR Annual percentage rate. 2 Sold the machine for 10000. Laptop sale price 500 capital allowances claimed 2000 minus the original laptop price 2000 500.

An adjustment known as a balancing charge may arise when you sell an asset give it away or stop using it in your business. Shortcut to Balancing Charges. What Is Capital Allowance Computation.

In the compound made from aluminum and oxygen the. The concentration of either protons or hydroxide ions can. Example 6 Lily Sdn Bhd accounts closed on 31 December purchased a milling.

Balancing charges are added to your taxable profits or are deducted from your losses in the year they occur. The finance charge would be the 15 of the average daily balance. If you close your business In the year you close your business enter a balancing charge or a balancing allowance on your tax.

Chapter 4 Investment Appraisal A Further Aspects Of Discounted Cash Flows

Ocr As Chemistry Balancing Ionic Equations Example 2 Youtube

7 Steps To Calculating Estimated Chargeable Income Eci Tinkertax

Solved Annual Allowance 20 14 40 10 Type Of Asset Chegg Com

7 Steps To Calculating Estimated Chargeable Income Eci Tinkertax

Balancing Adjustments On Pools And Review Of Capital Allowance Computation Acca Taxation Tx Uk Youtube

7 Steps To Calculating Estimated Chargeable Income Eci Tinkertax

Balancing Adjustments On Pools And Review Of Capital Allowance Computation Acca Taxation Tx Uk Youtube

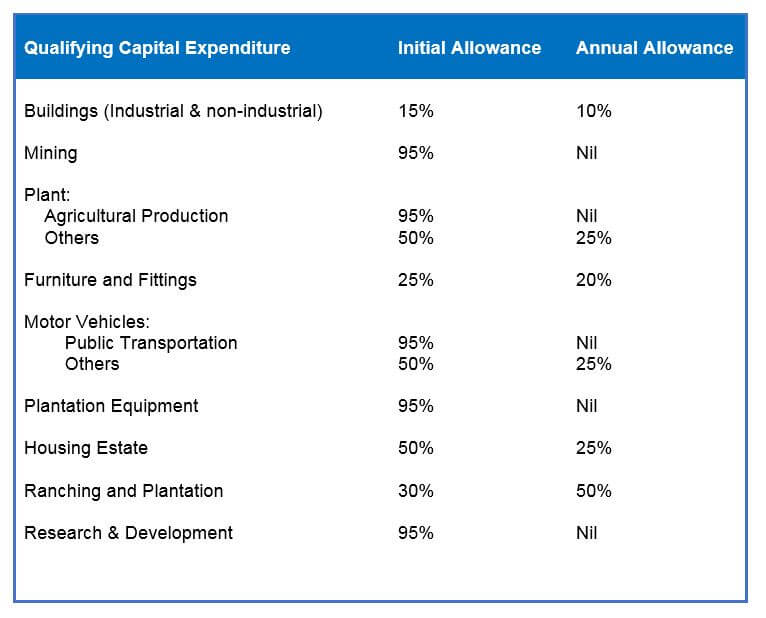

Capital Allowance In Nigeria Bomes Resources Consulting Brc

F6 P6 Capital Allowances Youtube

Solved The Following Is The Information Regarding Maya Enterprise Compute The Amount Of Capital Allowance Balancing Allowance Or Balancing Charge Course Hero

Solved The Following Is The Information Regarding Maya Enterprise Compute The Amount Of Capital Allowance Balancing Allowance Or Balancing Charge Course Hero

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

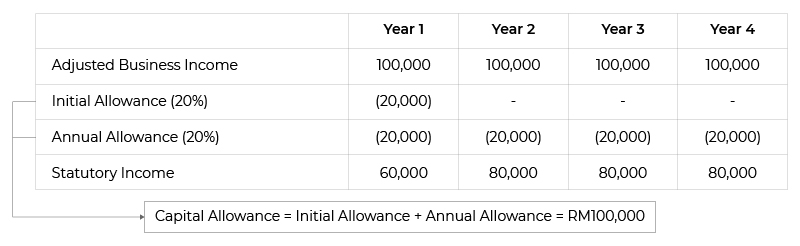

Capital Allowance Calculation Malaysia With Examples Sql Account

Chapter 4 Investment Appraisal A Further Aspects Of Discounted Cash Flows

Preparing The Capital Allowance Computation Acca Taxation Tx Uk Youtube